33+ Monthly home equity loan payments

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The major difference between home equity and HELOCs is that a home equity loan is a lump-sum payout.

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

Of your monthly income already.

. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. The Home Equity Loan Calculator is a quick and easy way to estimate a monthly payment your home equity loan. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

A HELOC is a line of credit for 15-30 years. Borrow money as you need it up to your line of credit limit. The borrower must then repay the loan through a series of scheduled payments.

Typically lenders will only approve a home equity loan or HELOC with an LTV ratio or CLTV ratio of up to 85 percent meaning you have 15 percent equity in your home. Should be advised to request a deferment or forbearance of the student loan payments. How to calculate monthly loan payments using calculators.

Home buyers who have a strong down payment are typically offered lower interest rates. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. The payment typically represents only a percentage of the full.

Youve got big plans. KeyBank can help you attain them with a home equity loan. You need money over time.

You need money over time. 15-30 years for. A home equity loans term can last anywhere from 5 to 30 years.

HELOC interest rates on the other hand are variable and can be somewhat higher depending on the bank and the prime rate. Also try our Home Equity Line of Credit HELOC Calculator. Home insurance also commonly called homeowners insurance often abbreviated in the US real estate industry as HOI is a type of property insurance that covers a private residenceIt is an insurance policy that combines various personal insurance protections which can include losses occurring to ones home its contents loss of use additional living expenses or loss of other.

Current home equity loan interest rates range from 415 to 1300 among the banks we reviewed. It has variable rates and offers a flexible payment schedule. An affordable second mortgage loan should fit comfortabily within your budget.

Home Equity Loans. Even though your available home equity is a major part of how much you can borrow through a home. Use our free mortgage calculator to estimate your monthly mortgage payments.

A down payment is a type of payment made in cash during the onset of the purchase of an expensive good or service. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. The smallest repayment you can make is 10 of the market value of your home.

Borrow up to 90 of your homes equity and receive all the money at signing. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Home equity loans and HELOCs may offer lower rates than debt consolidation loans though they come with more risks since your home is used as collateral.

This lets us find the most appropriate writer for any type of assignment. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan. Account for interest rates and break down payments in an easy to use amortization schedule.

View Home Equity Loan Amortization Schedule. If you need help. Let Bankrate a leader.

After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. Paying back part of your equity loan will reduce the monthly interest payments youll need to pay from the sixth year. Home equity loan vs.

400 x 33 13200. Has a fixed interest rate and regular monthly payments are expected. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Medical expenses can add up. 5-10 years for home equity loans. Mortgage loan basics Basic concepts and legal regulation.

Apply online to get started. With the cost of a wedding averaging more than 20000 4 a home equity loan can be an affordable ways to pay for a large event. So go ahead and plan.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Current home equity loan rates. Because of low interest rates a home equity loan may be an option when financing tuition and other education costs.

Our loans let you to borrow against the equity in your home with a fixed rate and term. Second mortgages come in two main forms home equity loans and home equity lines of credit. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Well help make sure you have the money you need.

Why its important. Rising Home Equity Through the middle of 2018 homeowners saw an average equity increase of 123 for a total increase of 9809 billion. Home Equity Products Home Equity Loan HELOC Interest-Only HELOC.

Home equity loan interest rates are typically on par with mortgage loan rates. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. You need a specific amount right now.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Second mortgage types Lump sum. Verify equity monthly payment expense date of final payment and term of contract.

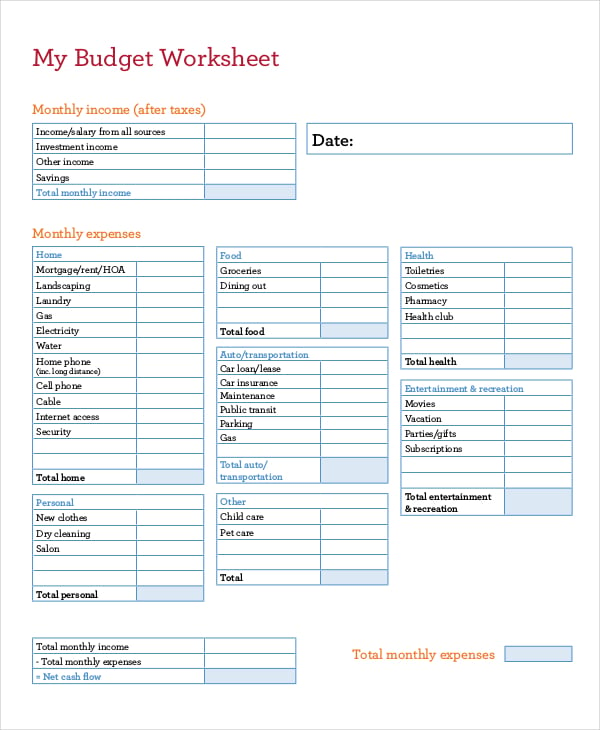

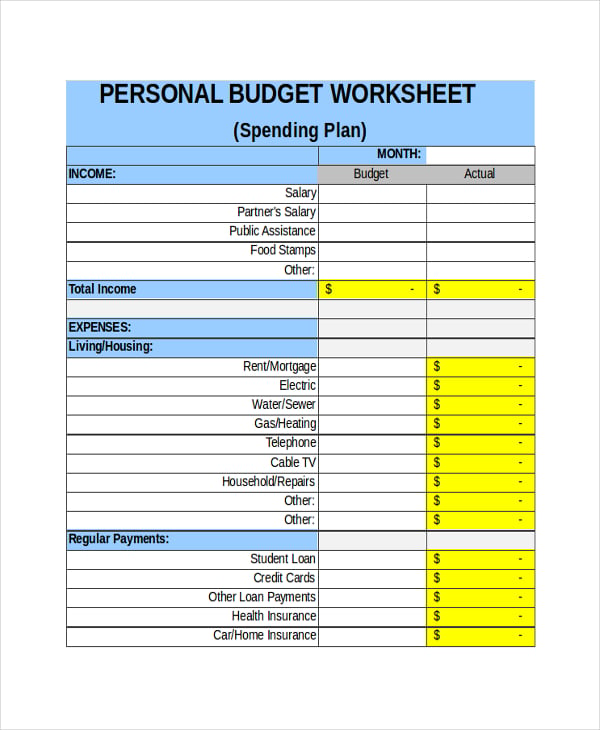

Free 33 Budget Forms In Pdf Ms Word Excel

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

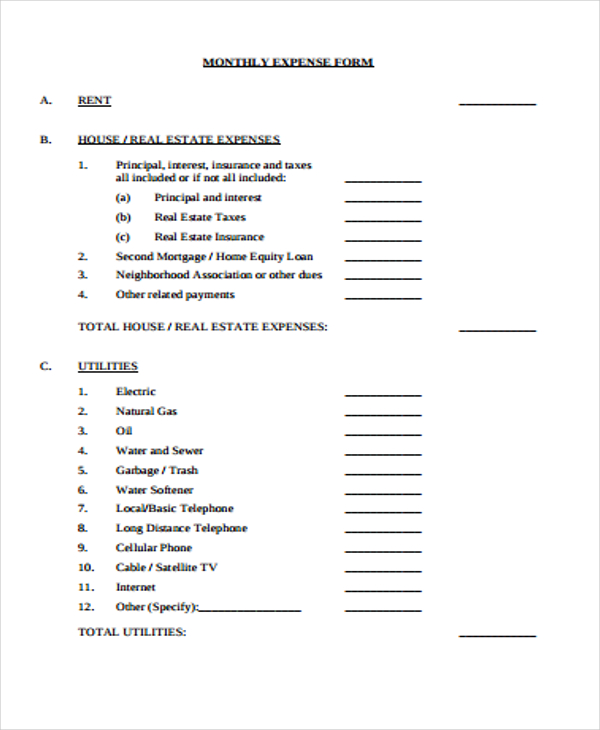

33 Expense Sheet Templates Free Premium Templates

Free 33 Budget Forms In Pdf Ms Word Excel

32 Expense Sheet Templates In Pdf Free Premium Templates

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

33 Sheet Templates Free Sample Example Format Free Premium Templates

Free 33 Budget Forms In Pdf Ms Word Excel

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

Free 33 Budget Forms In Pdf Ms Word Excel

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com

Change Of Address Notification Checklist Truity Credit Union Change Of Address Home Security Companies Credit Union

Free 33 Budget Forms In Pdf Ms Word Excel

Free 9 Property Investment Proposal Samples And Templates In Pdf Ms Word Pages Google Docs

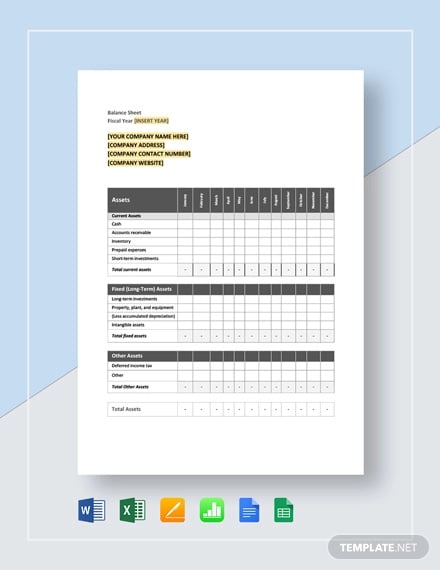

13 Balance Sheet Templates Free Samples Examples Format Download Free Premium Templates

Homes By Jerry Home Facebook

Auto Payment Calculator Top Sellers 53 Off Www Wtashows Com