Pay raise calculator with overtime

Divide the employees daily salary by the number of normal working hours per day. We use the most recent and accurate information.

Hourly To Salary What Is My Annual Income

5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV.

. Ad Create professional looking paystubs. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. So the overtime pay looks something like this.

In a few easy steps you can create your own paystubs and have them sent to your email. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. Of regular hours Regular rate per hour-Overtime gross pay No.

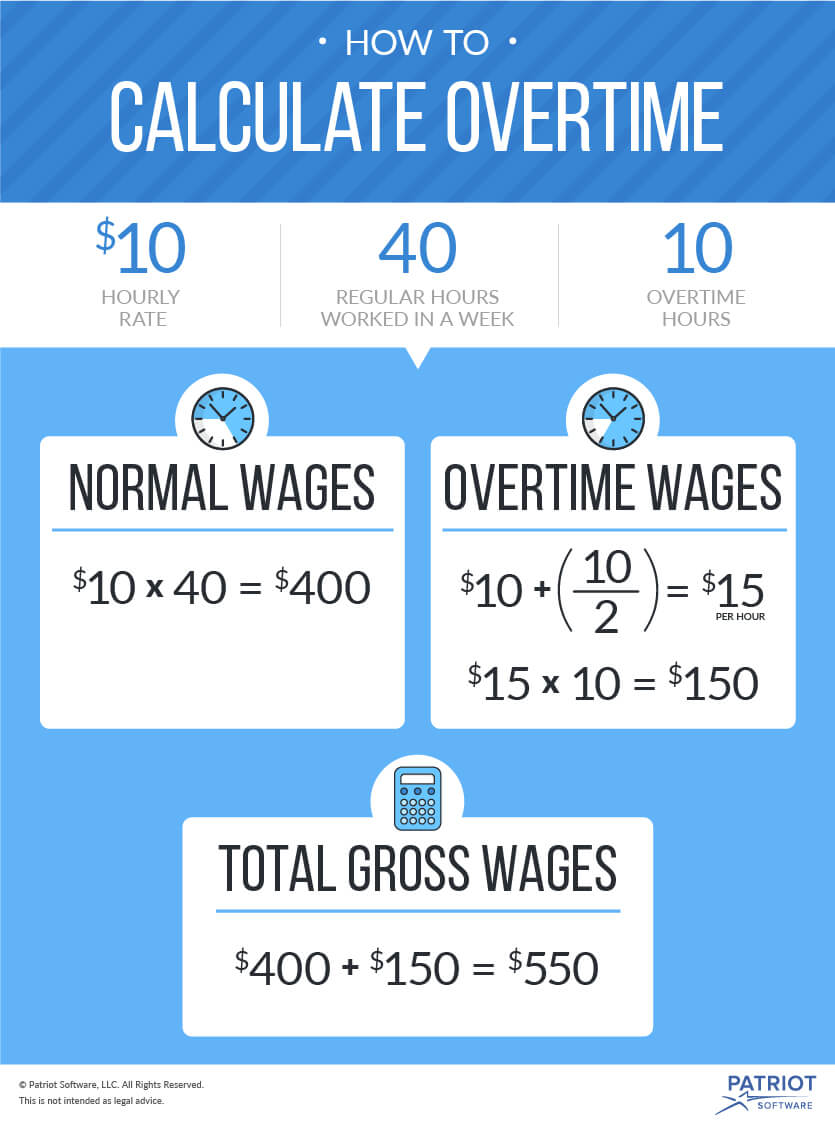

Follow the simple steps below and then click the Calculate button to see the results. The minimum rate under the FLSA is 15 so multiply the standard salary amount by. In this case your employee is entitled to overtime pay rate X 15 for the three hours of overtime they worked.

RM50 8 hours RM625. Overtime pay rates time and a half or double time are not. Use monthly gross payment amount.

1200 40 hours 30 regular rate of pay 30 x 15 45 overtime. Examples of payment frequencies include biweekly semi. Apply your overtime rate to calculate the amount of overtime to pay your employees.

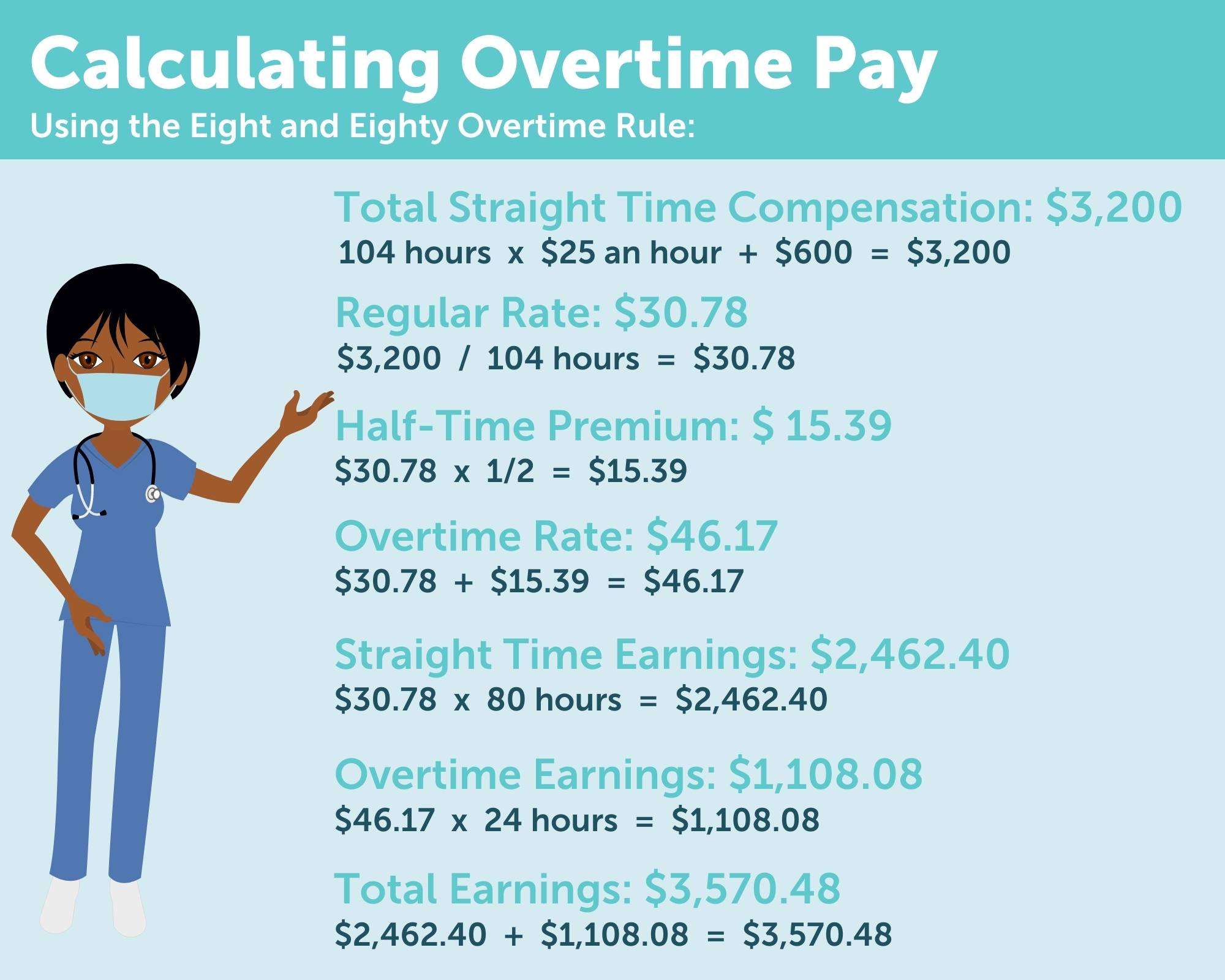

The employees total pay due including the overtime premium for the workweek can be calculated as follows. You can claim overtime if you are. Weekly gross pay x 52 pay periods 12 months.

Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that beginning on the first day of the first applicable. Unless exempt employees covered by the Act must receive overtime pay for hours. Enter your current pay rate and select the pay period Next enter the hours worked per week and select the.

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. 35 hours x 12 10 hours. The EX-IV rate will be increased to 176300 effective the first day.

Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then. 20 hourly rate X 15 overtime. Biweekly gross pay x 26 pay periods 12 months.

Hourly gross pay x average of hours. The overtime calculator uses the following formulae. Salary Calculator The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

If you are paid 50000 per year enter 50000 in the Before Raise Pay Rate edit box and select year in Pay Is By combo box.

Time And A Half Calculator Online 56 Off Blountpartnership Com

How To Calculate Blended Overtime In 2022

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Overtime Calculator Clicktime

Download Employee Ta Reimbursement Excel Template Travel Insurance Payroll Template Excel Templates

Hourly To Salary Calculator Convert Your Wages Indeed Com

Salary Overtime Calculator Calculate Time And A Half Double Time Wages

Pay Raise Calculator

How To Calculate Net Pay Step By Step Example

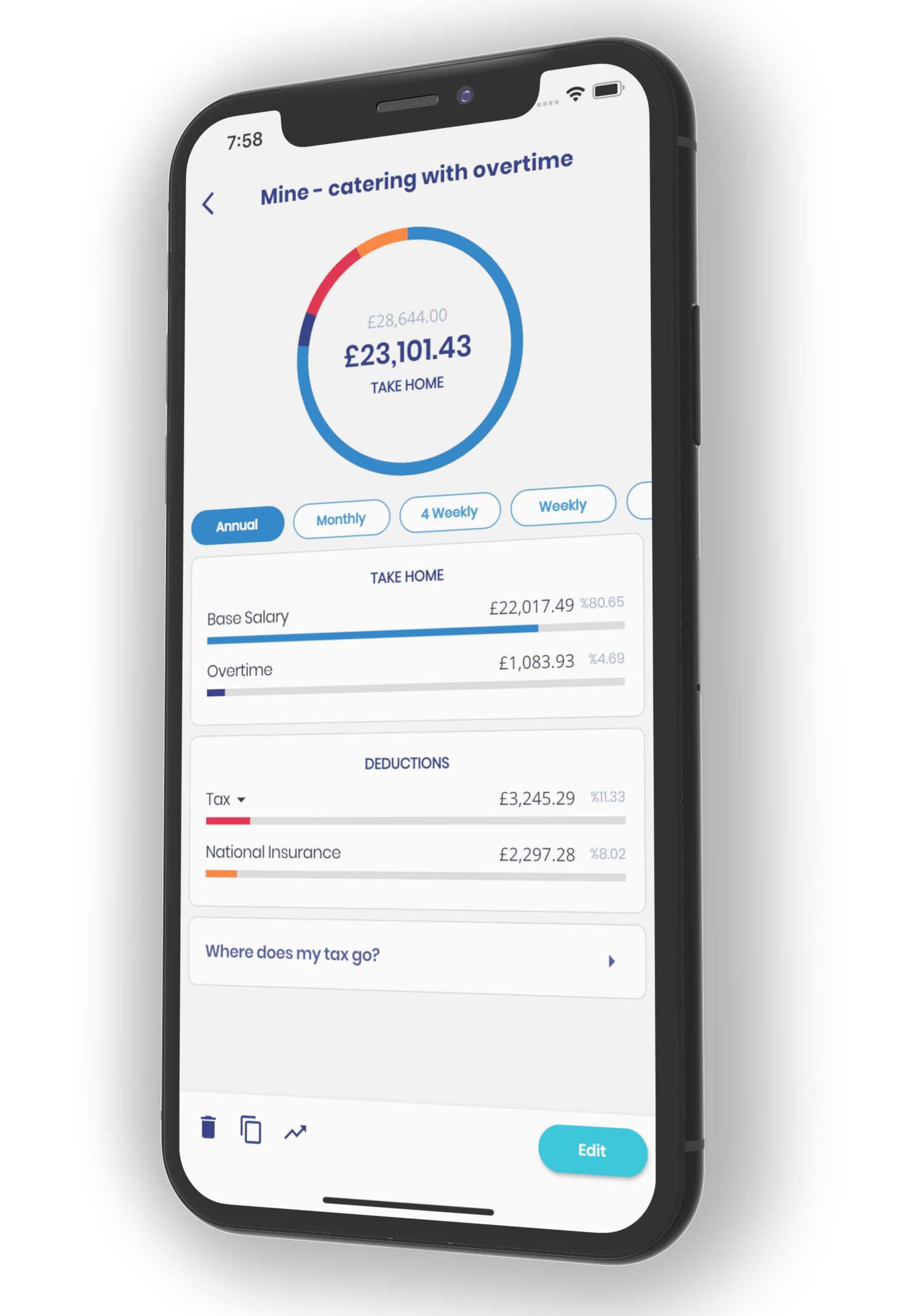

Salary Calculator App

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Overtime Calculator

Time And A Half Calculator Online 56 Off Blountpartnership Com

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Time And A Half Calculator Online 56 Off Blountpartnership Com

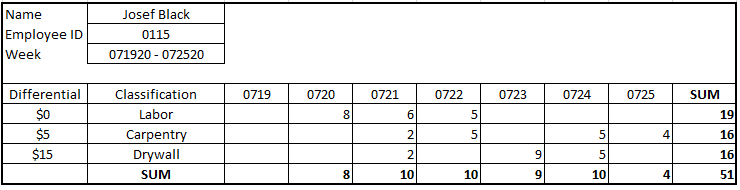

Shift Differential Pay Other Healthcare Payments Explained Aps Payroll

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs